As an oncology professional, whether in a locum tenens role or a direct-hire job, it’s crucial to safeguard yourself with the appropriate malpractice insurance.

However, many providers often find the distinction between occurrence and claims-made coverage confusing. This lack of understanding can lead to serious repercussions later on.

Knowing how each type of policy functions, along with their benefits and drawbacks, enables you to make informed choices and prevent expensive coverage gaps.

For oncology professionals managing complex patient cases, high-stakes procedures, and long-term patient care, the right malpractice insurance is more than a formality; it’s peace of mind. Choosing the wrong policy type or not understanding the fine print can expose you to unexpected risk.

Let’s quickly examine the pros and cons of occurrence and claims-made insurance.

Comparing Occurrence vs. Claims-Made: Pros and Cons

| Policy Type | Pros | Cons |

|---|---|---|

| Occurrence | Long-term protection without tail coverage | Higher initial premiums |

| Clear coverage period | It can be harder to find | |

| Claims-Made | Lower initial premiums | Requires tail coverage |

| Customizable over time | Risk of shared limits and potential gaps |

Now, we’ll explore each type of coverage in more detail.

Occurrence Malpractice Insurance

Occurrence-based policies cover any incident while the policy is active, regardless of when the claim is filed.

Key Advantages:

- Long-term protection: Even if a claim is filed years later, you’re covered as long as the incident occurred during your policy period.

- No tail coverage required: Once your policy ends, you’re still protected from incidents during that time.

Considerations:

- Higher upfront cost: Premiums for occurrence policies tend to be higher initially.

- Limited availability: These policies are becoming harder to find, especially for locum tenens professionals. However, Cancer CarePoint provides coverage specifically designed to address locum exposure.

The long-term peace of mind makes occurrence coverage a preferred option for many providers when available.

Claims-Made Malpractice Insurance

Claims-made policies cover you only if the incident and the resulting claim occur while your policy is active.

You must purchase tail coverage to maintain coverage for incidents that occur during the policy but are reported after it ends.

Key Advantages:

- Lower initial premiums: More affordable in the early years

- Adjustable over time: Flexible options as your career evolves.

Considerations:

- Tail coverage required: If you leave your job or the policy ends, purchasing tail coverage is necessary to avoid gaps.

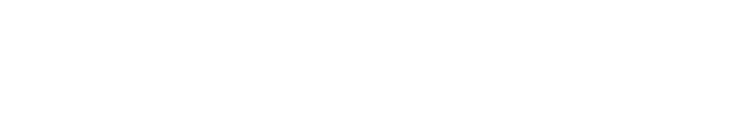

- Shared limits risk: If your coverage is through a staffing agency and it’s a claims-made policy, you could be sharing a single policy limit with other providers across multiple years, limiting your individual protection.

Think of claims-made coverage like a storage unit: you only have access while renting it. If you stop paying, the door closes, unless you buy a key to reopen it later (aka, tail coverage).

What is Tail Coverage?

Tail coverage, or extended reporting coverage, is a supplemental policy that protects healthcare professionals after a claims-made malpractice insurance policy has ended.

Because claims-made policies only cover incidents reported while the policy is active, tail coverage ensures that you remain protected if a claim arises after your employment or assignment has ended, as long as the incident occurred during your coverage period. This is especially important for providers who change jobs frequently or take on short-term assignments, such as those in locum tenens roles.

For locum tenens oncology professionals, tail coverage provides critical peace of mind. Oncology care often involves long-term treatment plans and delayed onset of side effects or complications, which means malpractice claims can surface months or even years after a patient interaction.

Providers could be personally liable for those claims without tail coverage once the original policy expires. By securing proper tail protection or, better yet, working with an oncology staffing partner offering occurrence coverage that doesn’t require it, oncology professionals can focus on delivering high-quality care without worrying about potential gaps in their liability protection.

An alternative is nose coverage (prior acts coverage), which is built into a new policy to cover past work. Nose coverage can be helpful when changing carriers, but it’s not always available and is usually more expensive.

Why Your Malpractice Coverage Choices Matter

As a 1099 locum tenens or W-2 oncology provider, your malpractice needs are as specialized as the care you deliver. Every contract, setting, and state may introduce new insurance requirements, and misunderstandings can lead to devastating financial consequences.

Choosing the right policy at the right time in your career

Your malpractice coverage should reflect your career goals, risk tolerance, and work structure. Here’s how to decide what fits best:

- New to practice or taking short-term roles: A claims-made policy may be more cost-effective—just be sure to plan for tail coverage.

- In a long-term or permanent role: An occurrence policy may cost more initially, but it offers peace of mind for the future.

- Frequently changing roles (locum tenens): Occurrence policies can simplify transitions and reduce the risk of coverage gaps.

At Cancer CarePoint, we’ve understood these complexities for more than 30 years. That’s why we ensure our healthcare professionals are equipped with tailored malpractice coverage explicitly designed for locum exposure, coverage you likely won’t find elsewhere in the open market.

Unlike many staffing firms that provide claims-made coverage with shared limits, our hourly-rated product offers individual, occurrence-form protection that gives you long-term confidence.

Disclaimer: Cancer CarePoint does not provide insurance advice or guidance regarding malpractice coverage selection. While we offer access to resources that may help you better understand your options, we do not advise on the complexities of medical malpractice insurance. Providers are encouraged to consult with a licensed insurance professional to determine the coverage that best suits their individual needs.